Remember in 2021 when so many of us got checks in the mail?

This was the Child Tax Credit, a version of which had never been seen before. It was refundable - meaning everyone got it even if they didn’t have a tax burden - and advanced - meaning that you got it ahead of time and not in April when you file taxes.

So what happened to it?

I teamed up with Dianne Kirsch of No Plan Press to do a graphic story on The Child Tax Credit for

.So read on…

I still remember getting that check in the mail, a complete “is this real?” moment. And for families hovering near the poverty line, this was a lifesaver - the 2021 Child Tax Credit cut child poverty IN HALF. This lifted over TWO MILLION kids out of poverty. So when we talk about solving problems we can at least look back to this and see that we’ve identified solutions that work.

Lowest child poverty ON RECORD. Seems like something we should be proud of, America, yes? But it wasn’t going to stay that way….

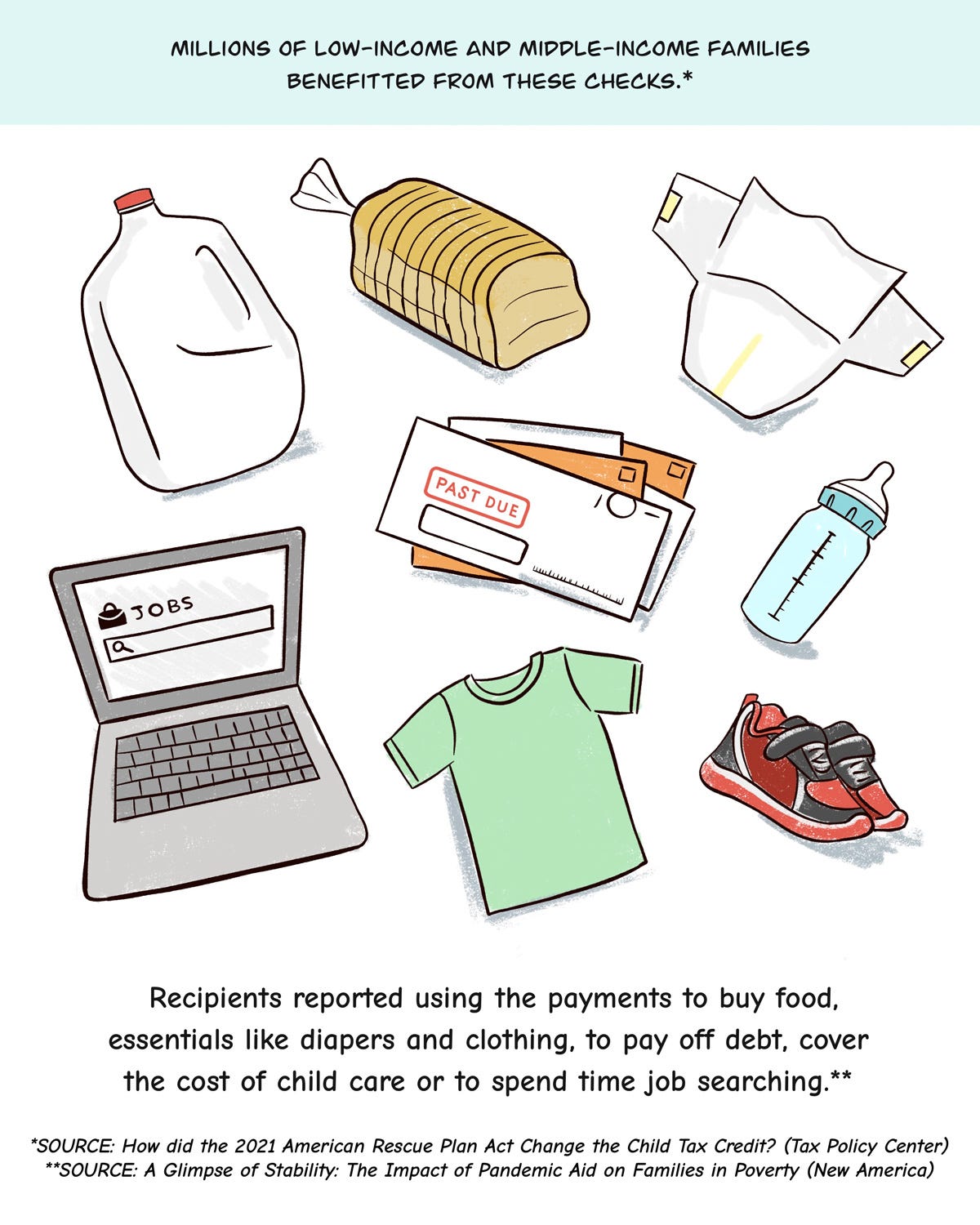

There was such significant investment in our social safety net programs during Covid that it gave researchers and journalists (and everyday Americans) a chance to view how an influx of cash could help people. Turns out, it does. Families used those checks for food, diapers, paying off debt and surprise, surprise CHILD CARE.

I’ve spoken to tax experts about refundability and this may be one thing where I fail to see how making things partially refundable or not fully refundable could be considered fair. Families who could most benefit from a handful of extra dollars are the ones we are cutting off - why? Because they don’t have a high enough tax burden? Instead of debating who is more worthy of the tax cut - why don’t we offer it to anyone who qualifies?

The 2024 campaign cycle did feature some prime time conversations around child care - and even a few ideas were put out there, including a newborn baby bonus, raising the income cap (so wealthier people can take it), making it refundable (yes please) and expanding the credit amount, possibly to $2500. My bet would be on the latter - the credit is overdue for an expansion and index to inflation and it’s popular with the GOP as well as the Dems.

So there is a tax credit you CAN use for child care costs - the Child and Dependent Care Credit. But this comes with a number of caveats - typically it’s used for licensed child care and with people who have the resources to have an employer who allows them to take the deduction, or the wherewithal to do the paperwork. If one parent stays home to care for children, the family isn’t eligible. One tax expert I spoke with thought this particular credit wouldn’t see much action because of the low uptake rate - because so few people take advantage of it, it doesn’t cost the Treasury much money.

Long story short - those checks aren’t coming back.

But let’s end on a positive note - we have evidence that a program works to cut child poverty in half.

We have some bipartisan agreement that families need more support.

There are myriad ways to use the tax code to assist families and make child care more affordable.

But we aren’t necessarily going to see positive changes now. I’m hopeful that something could shake out - even an increase in the CTC would be good for families. But making it fully refundable is key - and understanding the difference and why it matters is a good place to start.

A version of this graphic story appeared in Early Learning Nation.